Industrial policy is a set of interventionist measures decided by the authorities in order to develop some economic activities and to promote structural change. In other words and as summarized by Cohen & Lorenzi in âPolitiques industrielles pour lâEuropeâ [Industrial policies for Europe], industrial policy aims at promoting sectors that call for public intervention, either for national independence motives or due to some failure of private initiative, decline of traditional activities or loss of territorial balance.

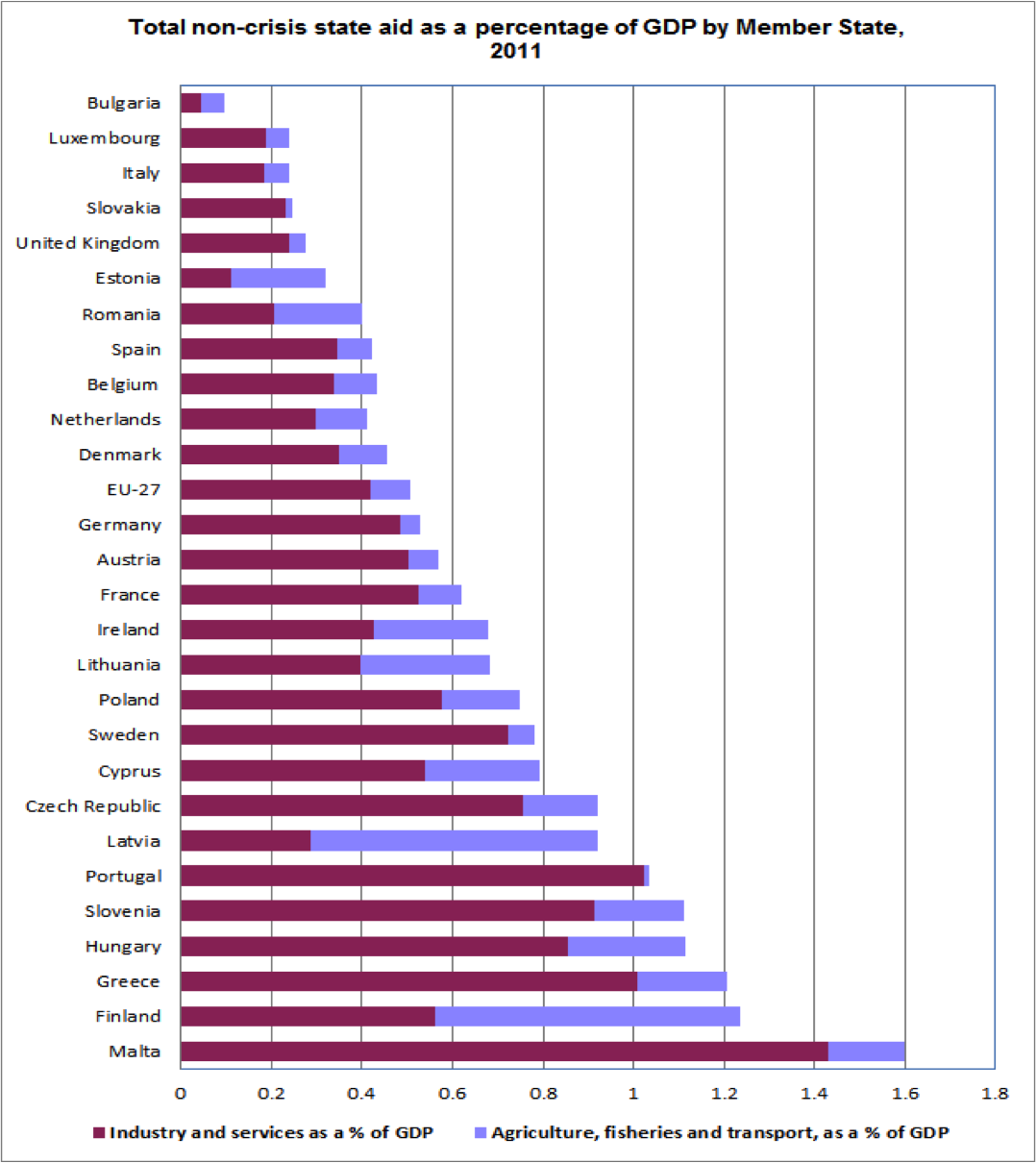

In 2011, the sum of subsidies granted by european states that were not related to the crisis in Europe amounted to 64.3 bnâ¬, meaning 0.5 % of the EU GDP. According to the latest â€Report on state aid granted by the EU Member Statesâ€, the 5 member states that granted the highest aid volumes to industry and services were Germany (13.6 bnâ¬), France (12.3 bnâ¬), the UK (4.8 bnâ¬), Spain (4.5 bnâ¬) and Italy (3.8 bnâ¬). When state aids are expressed as a percentage of GDP, France then falls within the European average.

In 2011, the sum of subsidies granted by european states that were not related to the crisis in Europe amounted to 64.3 bnâ¬, meaning 0.5 % of the EU GDP. According to the latest â€Report on state aid granted by the EU Member Statesâ€, the 5 member states that granted the highest aid volumes to industry and services were Germany (13.6 bnâ¬), France (12.3 bnâ¬), the UK (4.8 bnâ¬), Spain (4.5 bnâ¬) and Italy (3.8 bnâ¬). When state aids are expressed as a percentage of GDP, France then falls within the European average.

The four main objectives that single-handedly amount for 75 % of total aids are (1) environment and energy savings, (2) regional development in order to favor firms†installation in some regions, (3) research & development and innovation, and (4) support to SME.

Because of the crisis, industrial policy is getting back as a matter of importance in political speeches. In France, Arnaud Montebourg and the much vaunted â€Ministère du Redressement Productif†[Ministry of Productive Recovery / Ministry of Productivity Promotion] symbolize it. But letâ€s try to ask ourselves the right questions by analyzing the pros and cons of setting up new industrial policies.

Letâ€s start by two questions: is it in the remit of the State to define the strategic industrial orientations of a country by promoting some industries? Do bureaucrats and politicians at the head of a country have the capacity to detect â€future thriving industries†without being influenced by lobbies or some suitcases full of cash? Needless to say that stated that way we could be tempted to answer â€No!†Regarding the first point, even if we consider that politicians†choices can be free of pressure from the lobbies and any bribery, the State will necessarily happen to make wrong choices, and sectors that appear promising will reveal themselves as money pits. In this case, the role of the State isnâ€t to blindly reject the possibility of a failure (that would imply no risk taking) but to limit its losses in case of a mistake (see Rodrick (2005), Industrial Policy for the 21st century, Harvard University).

â€Optimally, mistakes that result in â€picking the losers†will occur. Public strategies of the sort advocated here are often derided because they may lead to picking the losers rather than the winners. It is important of course to build safeguards against this, as outlined above. But an optimal strategy of discovering the productive potential of a country will necessarily entail some mistakes of this type. Some promoted activities will fail. The objective should be not to minimize the chances that mistakes will occur, which would result in no self-discovery at all, but to minimize the costs of the mistakes when they do occur. If governments make no mistakes, it only means that they are not trying hard enough".

Then what are the supporting arguments for industrial policy implementation (and therefore State intervention to encourage the development of some sectors)?

Economists who advocate for some State interventionism put a strong emphasis on the fact that information is imperfect on the markets and that some externalities prevent resources from being optimally allocated. An example of imperfect information pointed out by Pierre-André Buigues in â€La Politique Industrielle en Europe†[Industrial Policy in Europe] is the fact that the financial system can restrict credits and funding to SME due to a lack of information on their chances of success. Indeed, it may be difficult for an SME or a start-up to get some funding from classical commercial banks (characterized by risk aversion and prudential rules). In that case, an industrial policy that would favor the access to credit for SME (public investment bank, State guarantees) could allow to correct this market anomaly and be beneficial for the country

Likewise, negative externalities (pollution by some firms that donâ€t even have to face the cost of polluting) or positive externalities (technological innovation that would benefit the whole sector) can be the subject of an industrial policy aiming at reducing negative externalities and favor positive externalities as much as possible (for instance by granting subsidies to or favor research and development in ecological sectors).

The right balance has then to be found between the benefits of State interventionism that can promote some sectors and try to make up for markets†failures and the risks introduced above (bribery, pressure from lobbies, inability to identify precisely high-growth sectors and competition imbalance). Even if all this sounds feasible, it is in reality extremely complicated provided the difficulties to evaluate and quantify the costs and benefits associated to each industrial policy (making it a posteriori is already complicated, all the more so as to make it a priori).

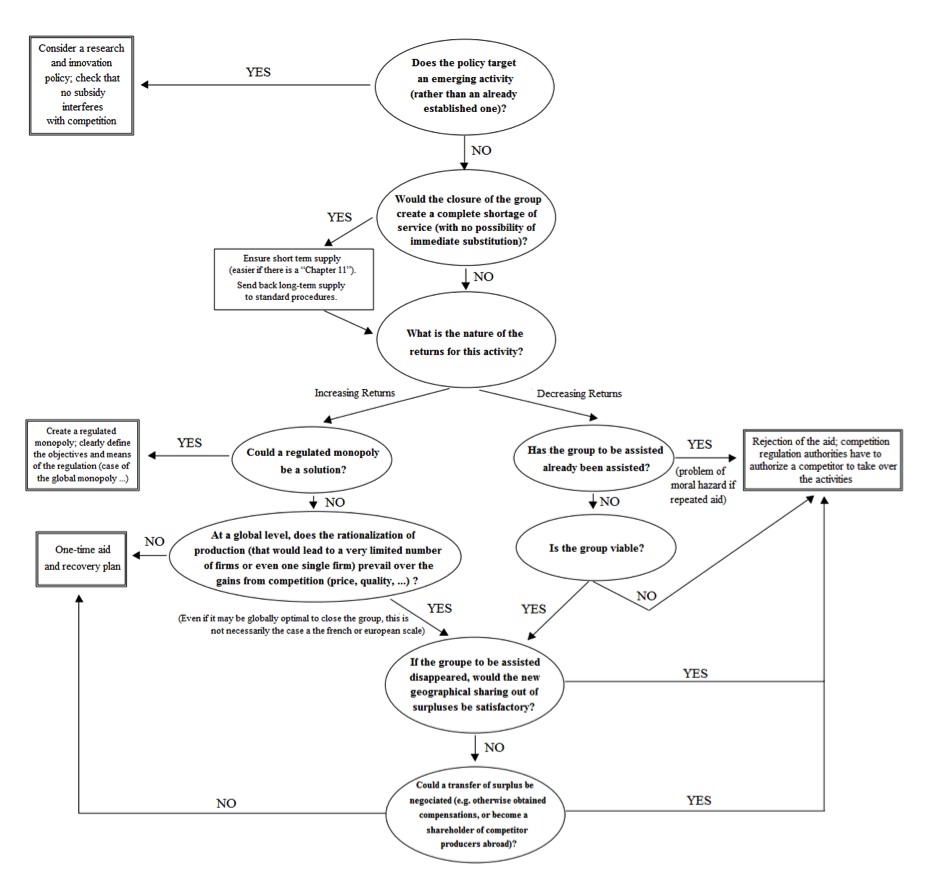

In a work document of 2005, the â€Ministère de lâ€Economies, des Finances et de lâ€Industrie [Ministry of Economy, Finance and Industry / Treasury Department] shows in an appendix of the document â€Politique industrielle et politique de la concurrence†[Industrial policy and competition policy] a very interesting tree of justification of industrial policies that allows to identify which situations theoretically lead to a â€rejection of the aidâ€, which ones should end with a â€one-time aid†and a â€recovery planâ€, etc. For instance, a non-viable group that has already received state aid or of which the disappearance would lead to a satisfactory new geographical sharing out should not receive any aid. Thatâ€s all. That is sad for this groupâ€s employees, but thatâ€s what Schumpeterâ€s â€creative destruction†is all about. So thatâ€s all fine to pretend to be interested in the protection of these jobs in front of the cameras (governments from the right to the left wings targeted here), but letâ€s look ahead instead of concentrating on what will soon belong to the past …

Conclusion: markets donâ€t perfectly operate, both when the State does not take enough action (imperfect information, externalities) and when it steps too much in (competition imbalance, efficiency loss). Industrial policy makes sense if it aims at correcting market stains by championing the development of some sectors that appear to be promising and could bring a comparative advantage to the country in the future (with positive consequences for the whole economy - the spillover effect) . Industrial policy is however meaningless if it is used for protection of aging sectors for which the country has no comparative advantage and that are condemned to disappear in the medium / long term.

Cet article est mis à disposition selon les termes de la licence Creative Commons Attribution - Pas de Modification 4.0 International. N'hésitez donc surtout pas à le voler pour le republier en ligne ou sur papier.

Cet article est mis à disposition selon les termes de la licence Creative Commons Attribution - Pas de Modification 4.0 International. N'hésitez donc surtout pas à le voler pour le republier en ligne ou sur papier.